Brexit and the Impact on SAP Customers. Part 3

Author: Claire Neale, Solution Architect, NTT DATA Business Solutions UK.

This is the third in the series of Brexit blogs we are delivering in an attempt to help you navigate the changes introduced to your processes as a result of Brexit and the impacts they have on your SAP systems.

SAP are continuing to monitor changes relating to Brexit and are delivering, on a daily basis, patches to support all changes related to Brexit. Aside from what has already been covered in the previous blogs, this will hopefully provide you with a bit more clarity around the further updates that have been issued and cover functional changes not captured in the previous blogs.

Functional Changes

Functional changes not covered in my previous blog include the following:

- Postponed VAT Accounting

From 1 January 2021, Brexit has introduced changes to how businesses complete their VAT Returns if they are a UK VAT-registered business and import goods into the UK (England, Scotland and Wales) from anywhere outside of the UK, or into Northern Ireland from anywhere outside of the UK or EU.

Note: There will be no changes to the treatment of VAT or how it is accounted for, for the movement of goods between Northern Ireland and the EU.

Postponed VAT Accounting allows businesses importing goods to account for the VAT on their VAT Return, rather than paying it immediately (e.g. at the port of entry).

The purpose of postponed VAT accounting is to avoid an impact to cash flow as a result of importing goods. If the business already imports goods from outside of the EU, then a cash flow benefit might be seen, as this accounting for VAT removes the need to account for the import VAT typically due. VAT becomes payable on imports coming into the UK from anywhere in the world if they’re over £135 and from 1st January 2021, this now includes goods imported from the EU.

The postponed VAT accounting system aims to avoid the negative cash flow impact on businesses that are hit by this additional VAT bill and will avoid having goods held in customs until the VAT is paid. It works in a very similar way to the reverse charge mechanism used for EU trade prior to Brexit. Rather than physically paying import VAT and then reclaiming it on the subsequent VAT return, the VAT is accounted for as input and output VAT on the same return. The outcome is the same, but the importer has avoided the physical payment.

Use of the postponed VAT accounting scheme is optional. The business can, if they choose, still pay the VAT upfront when the goods enter free circulation in the UK (at the port of entry or after release from a customs warehouse).

Postponed VAT accounting can be used by all VAT-registered businesses in the UK, although businesses in Northern Ireland will continue to be considered part of the EU VAT area (i.e. goods arriving from the EU will not be considered imports and will therefore not incur import VAT) however, they can still use postponed VAT accounting for imports from non-EU countries.

Completing Brexit Postponed VAT Accounting import VAT return

Businesses, who defer their import VAT payments, can access a postponed import VAT statement online of all their imports where they opted to postpone the import VAT through the customs clearance paperwork. Each statement shows the total import VAT postponed for the previous month and are available to view in the first half of each month. The statements can be used for reporting in the subsequent monthly or quarterly UK VAT return as follows:

Box 1 – Total VAT due in this period on imports accounted for through postponed VAT accounting.

Box 4 – Total VAT reclaimed in this period on imports accounted for through postponed VAT accounting.

Box 7 – Total value of all imports of goods included on your online monthly statement, excluding any VAT.

If businesses don’t use postponed VAT accounting, and instead pay the VAT immediately when the imported goods enter free circulation, they will need to complete boxes four and seven only.

Guidance on Postponed Accounting can be found via the following link:

As a result of the introduction of the Postponed Accounting for VAT, changes are required to the VAT return produced from SAP, in terms of the tax box mapping; OSS Note 2996657 details the required changes.

- Distance Selling

Distance selling thresholds for UK e-commerce sellers of goods to EU consumers have been removed. Goods are now be subject to import VAT, and UK sellers will have to consider registering for VAT in Europe immediately where they sell to customers in the EU. Similarly, EU e-commerce sellers may now need to register immediately for UK VAT, if they have been selling to UK consumers under the £70,000 threshold.

- Plants Abroad

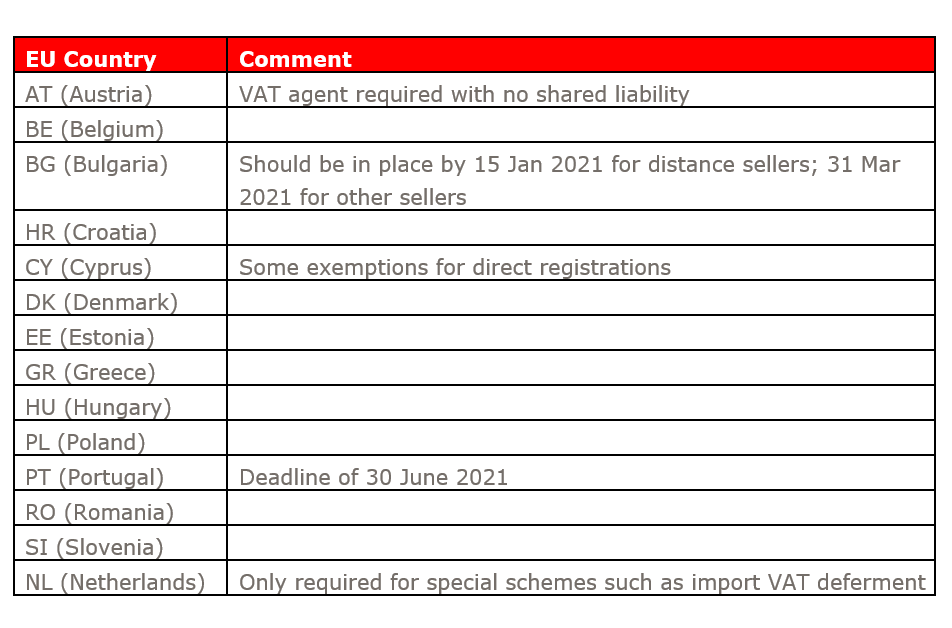

Any UK business with a foreign VAT registration in the EU (plants abroad) may now face the obligation to appoint a special VAT fiscal representative. These agents hold direct liability for any unpaid VAT, and, therefore, will require cash deposits or bank guarantees in exchange. This requirement applies to the following countries:

- Scrapping of the £15 low-value consignment stock relief in UK

The UK £15 low-value consignment stock relief, which exempted imports of goods from VAT, has now been scrapped. Instead, for goods at £135 or below, sellers or their postal service have to declare and pay to HMRC via a new, quarterly filing, VAT charged at the point-of-sale.

- UK Businesses using MOSS registration

For UK sellers of digital services to EU consumers, the UK is no longer be a member of the EU Mini One-Stop-Shop (MOSS) single VAT return scheme. UK sellers of electronic, broadcast or telecoms services to consumers will therefore have to register in any other EU state, as a non-Union businesses, to continue to file their VAT declarations for EU e-service sales. EU sellers into the UK will have to now register with the UK’s HMRC for the same declaration.

Any non-EU business which used the UK MOSS registration now has to reregister for MOSS in the EU and separately in the UK under a regular VAT return.

- SEPA Payments

Whilst the UK will remain in the SEPA payments system, the following should be noted:

−Where payments are made for over 1,000€ outside of the EU, the payer’s address must be included in the payment data.

This limit also applies where the amount is split into several payments.

As several banks have indicated that they will reject payments without the appropriate address data, SAP strongly recommends that you ensure that address data is included in every payment record.

SEPA (pain.001.001.03 and pain.008.001.02) formats are part of the SAP-delivered package for CGI Formats and already contain the address information, and SAP payments run populates the address information for all payments.

OSS Note 2253571 is a collective note on SEPA CGI formats.

Key SAP OSS Notes:

The main OSS notes were identified in my previous blog, however it should be noted that updates to some of these notes are being made on a regular basis, so it is worth checking the notes mentioned in that blog for further updates.

- The overarching OSS Note under which all most of the key changes are captured is 2885225 – BREXIT: Through the Transition Period and Beyond. A link to this note is provided below:

https://launchpad.support.sap.com/#/notes/2885225

This note has been updated to include an attachment of a document capturing Brexit FAQ’s which you may find very helpful.

In addition the following notes are also applicable:

- 2074351 – Deactivating EU relevant tax codes from UK tax procedure, removing them from F4 help (should only be carried out once all EU relevant transactions have been completed).

- 2765681 – Captures all of the changes for Contract Accounting (FI-CA).

- 2766031 & 2770937 – to support use of tax codes flagged as EU relevant after 31.12.2020.

- 2999842 – for derivation of VAT registration number for delivery of goods from EU to Northern Ireland (note that a pre-requisite to this OSS note is all those relating to the Northern Ireland protocol captured in my previous blog).

- 3001298 – for determination of VAT registration numbers for Northern Ireland for goods sold from EU to NI (note that a pre-requisite to this OSS note is all those relating to the Northern Ireland protocol captured in my previous blog).

- SAP Notes 2766031 and 2770937 enable EU-relevant tax code postings after 31.12.2020 for goods transferred between EU & NI.For customers located in Northern Ireland there will be no default for “Reporting Country” (EGMLD) and VAT identification number (STCEG) in FI posting transactions like FB01, FB70. Instead the user identify “Reporting Country” (which is used to derive the VAT identification number from customer master record). For FI postings covering goods deliveries from the EU to Northern Ireland, ‘XI’ must be entered as the tax reporting country. The system derives the XI VAT registration number from KNA1-STCD6/LFA1-STCD6.

- In case of CPD customers: If Country ‘GB’ is entered, the system will do the consistency checks for country ‘GB’, but allows entering a VAT Registration Number starting with ‘XI’ after SAP note 2999842 has been applied.

- For intercompany transactions, more sophisticated logic may be required to determine the correct tax code specified in OBCD – if required OSS note 2940951 should be considered.

- Postponed VAT Accounting as identified above OSS note 2996657

- OSS note 2778393 to enable restriction of VAT registration numbers in EC sales list so that for example those prefixed with GB are not included

If any of the recommendations listed above has given you something to consider, or you’re considering the impact of Brexit on your SAP system, then NTT DATA Business Solutions can help.

Please raise a ticket initially via the portal so we can capture that question or request.

Remember to check back regularly for the next in our Blog series on Brexit.