Brexit and the Impact on SAP Customers Offering Services in Europe. Part 4

Author: Claire Neale, Solution Architect, NTT DATA Business Solutions UK.

This is the fourth in the series of Brexit blogs we are delivering to help you navigate through the series of system and process changes introduced, which came into force from 1st January 2021.

We are not tax experts, so these blogs should not be considered as alternatives to contacting your tax advisors. We would recommend that any specific tax queries are raised with your tax advisors.

This blog is specifically focused on the delivery of services from the UK to other countries in the EU or Northern Ireland and vice versa. It should be noted that the rules surrounding the provision of services are still quite vague, but this blog covers what we know so far.

Functional Changes

SAP recommends that where you provide both goods and services to your customers in Northern Ireland that you should split the invoices. I would go as so far to say this should be the same where you provide goods and services from UK to the EU and vice versa.

What we know so far:

There is still a distinct lack of guidance surrounding the sale of services between UK and countries in Europe. Whilst it has been made clear that UK firms within a variety of service sectors can continue to access the EU market (as business travellers, as cross-border service suppliers or investors), they are to be treated no less favourably than either EU businesses or competitors from third countries. There are still changes which need to be adhered to as a result of no longer operating under European Economic Area (EEA) regulation.

The changes which have been introduced vary by member state and by sector. Businesses providing services or investing in any EU country, Iceland, Norway, Switzerland or Liechtenstein should review the respective country guidelines which can be found via this link

Broadly, the guidelines by country are:

- The appropriate authorisations or licences to provide the service are in place

- Specific local business regulations in the respective country have been complied with

- EEA nationality requirements (which could prevent you from providing services in some sectors) have been complied with

- Provision of a link to the government portal for each of the countries you provide services to, so that the local rules and regulations for the provision of services can be checked and adhered to

The HMRC guidelines also recommend appointing a lawyer in the respective country to ensure that local regulations are adhered to.

How to determine which country’s rules VAT rules should apply

If you are providing services between the UK and EU, you must first determine which country’s VAT rules apply i.e. whether it is the country of supply (the business providing the services), or the country of consumption (the customer’s country where the services are being provided to). If the latter, then you should check the specific country guidelines to see whether you have to register for VAT in that country and pay any taxes due.

The General Rule applies to most services, and remains unchanged following Brexit. But there are also Special Rules related to certain B2C supplies. The compliance rules have changed for Brexit, and will likely change further as the UK sets its own VAT strategy.

General Rule

- B2B services provided by a UK business to a customer which is an EU customer in the country where customer is resident

Where the customer is outside of the UK, then the General Rule still applies, whereby the service is treated as being outside the scope of UK VAT and therefore zero-rated.

In this instance EU customer then uses the ‘reverse charge’ tax regime to report the VAT in their return.

Pre-requisite: You must obtain evidence that the customer is outside of the UK; this is normally evidenced via a valid VAT registration or Tax Id from the country where they are resident. If this is not available, then they should be treated as a B2C supply.

The same rules apply to EU businesses supplying services to customers which are UK businesses (VAT is accounted for via Reverse Charge in the UK).

The UK business no longer has to produce the EC Sales List for sales made in the EU, likewise the EU business selling to a UK business customer will no longer include the sale on their EC Sales Lists.

- B2C – services provided by UK business to a EU customer which is a consumer

The UK business will charge UK VAT to the EU customer (and vice versa where EU business supplying to UK consumer). This continues to operate in the same way as pre Brexit, however, there are some special rules which need to be applied for certain services and these apply VAT according to the country where the customer is resident.

Special Rules

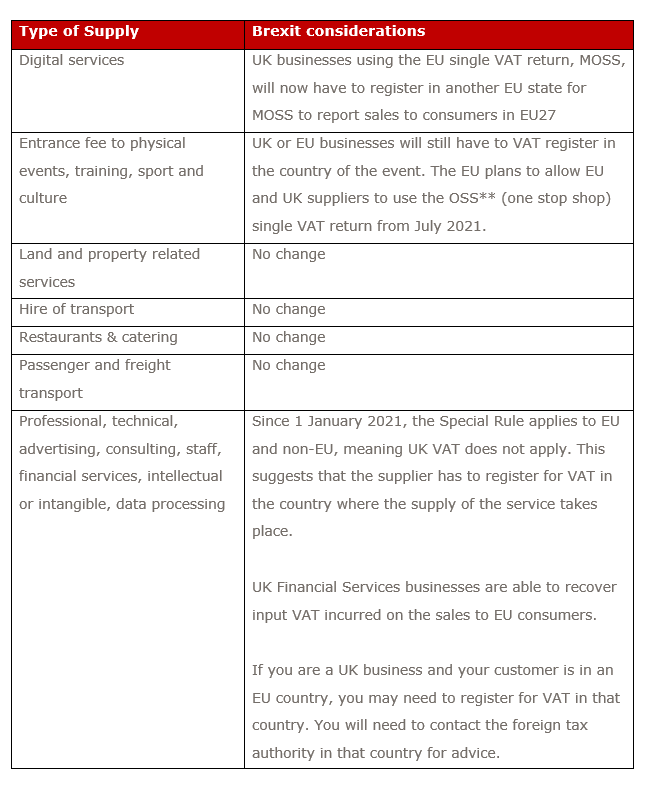

The VAT B2C rule that tax is applied to cross border supplies based on where the supplier is located is reversed in the following types of supply:

**One-Stop-Shop (OSS) VAT return

OSS returns will be filed on a quarterly basis. Sellers continue to declare VAT on sales to consumers in their own country through their domestic VAT return. In addition to the OSS return is also required.

If you have any questions please raise a ticket initially via the portal so we can capture that question or request.

Remember to check back regularly for the next in our Blog series on Brexit.